Join Our Telegram Channel

Join Our Whatsapp Group

Monday 14th July, 2025

Economics (Objective & Essay) — 10:00 am – 1:00 pm

ECONOMICS OBJ:

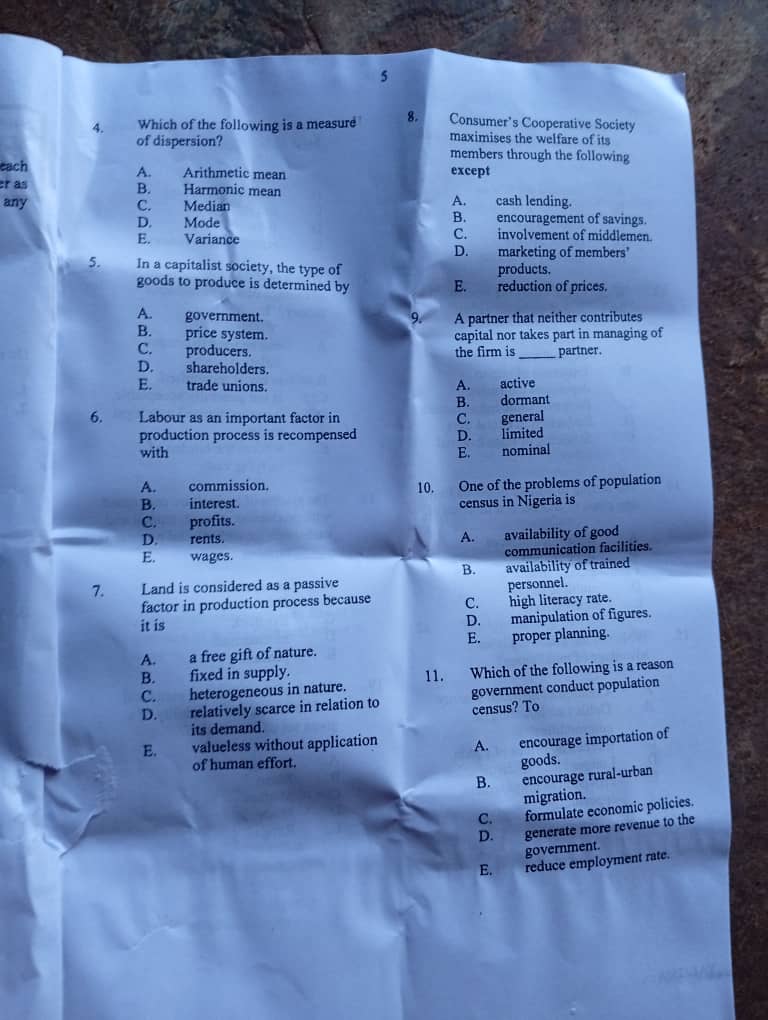

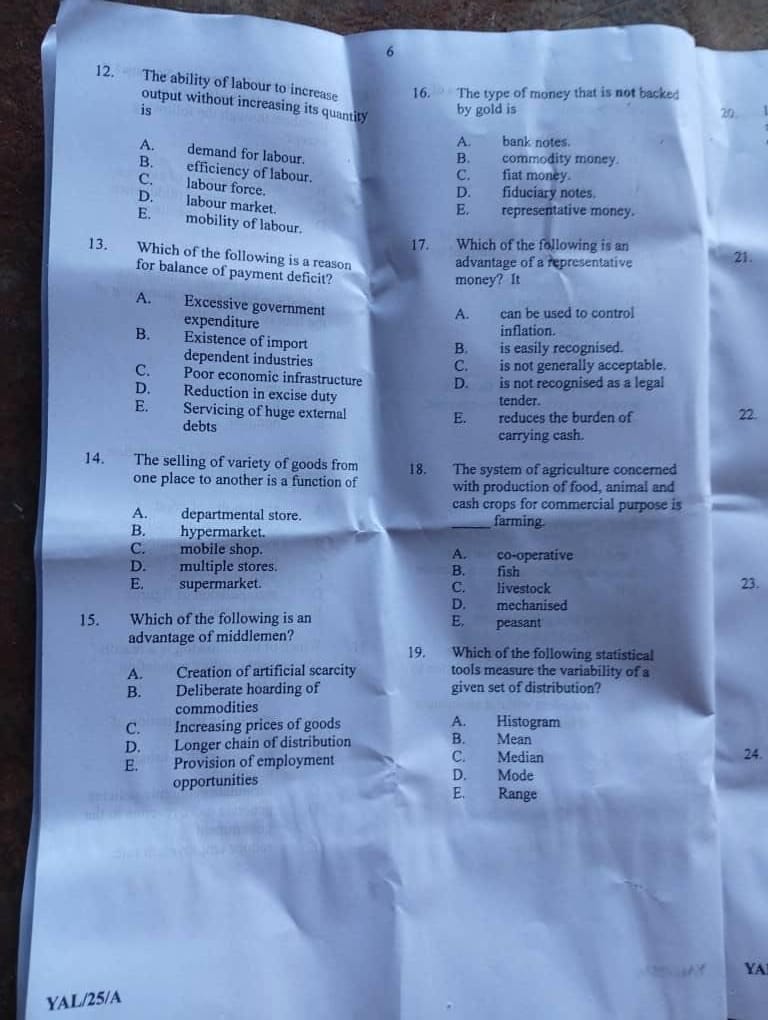

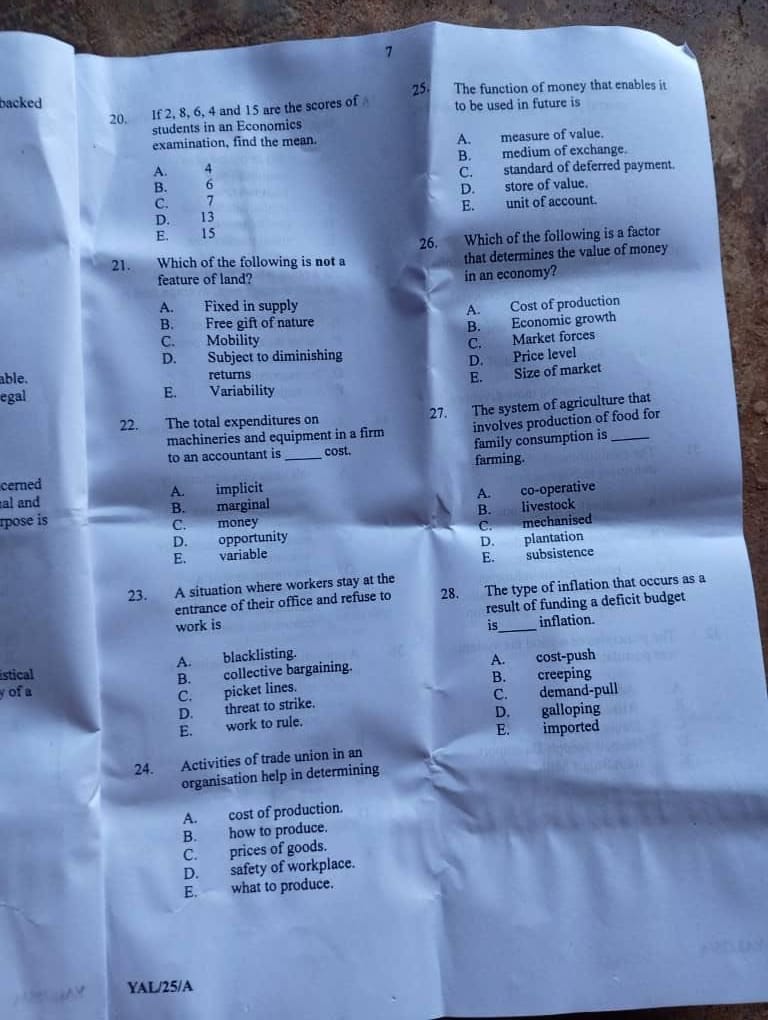

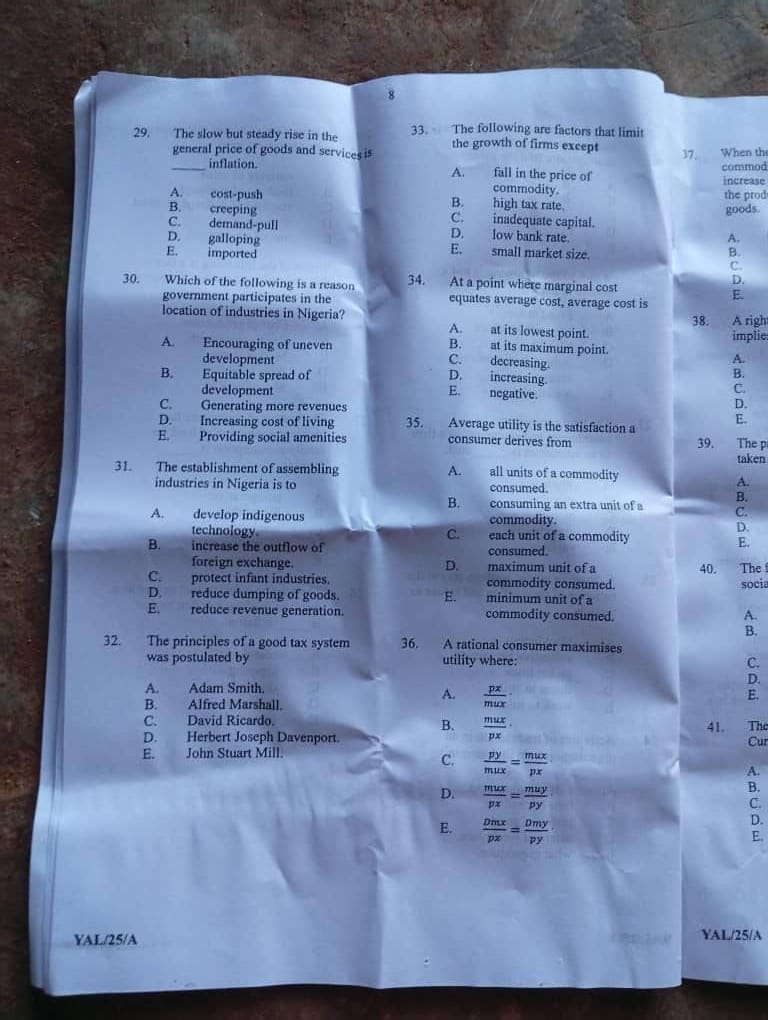

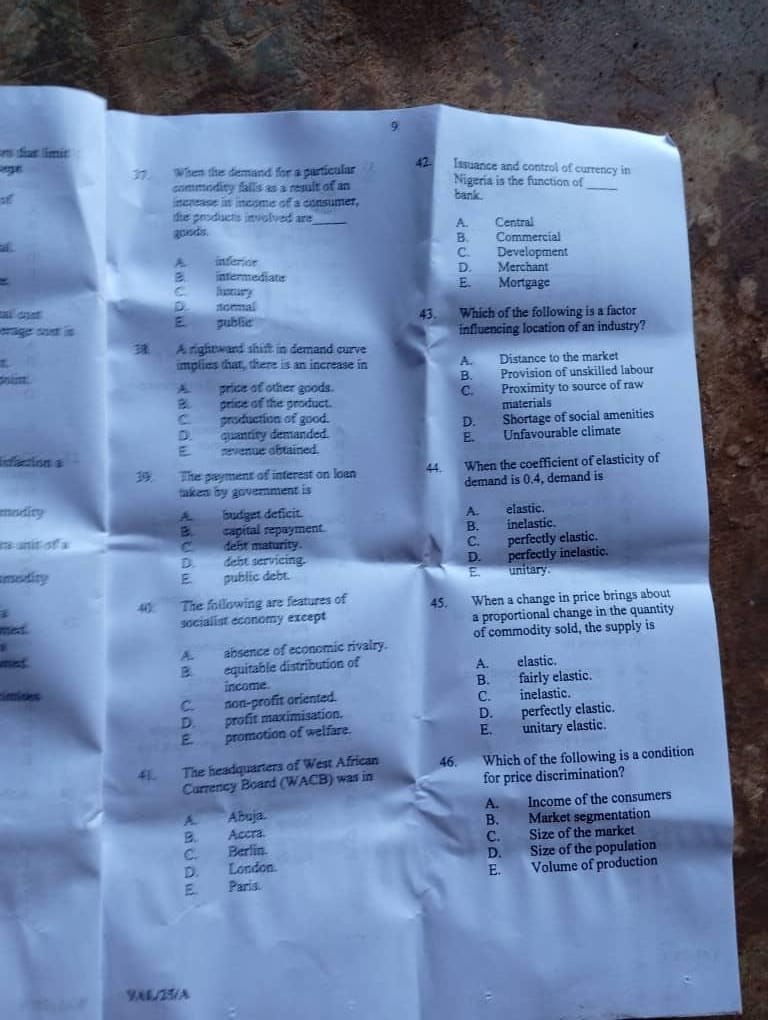

1-10: BECEBEBCED

11-20: CBECECEDEC

21-30: CCCDDDECBB

31-40: CADACDADDD

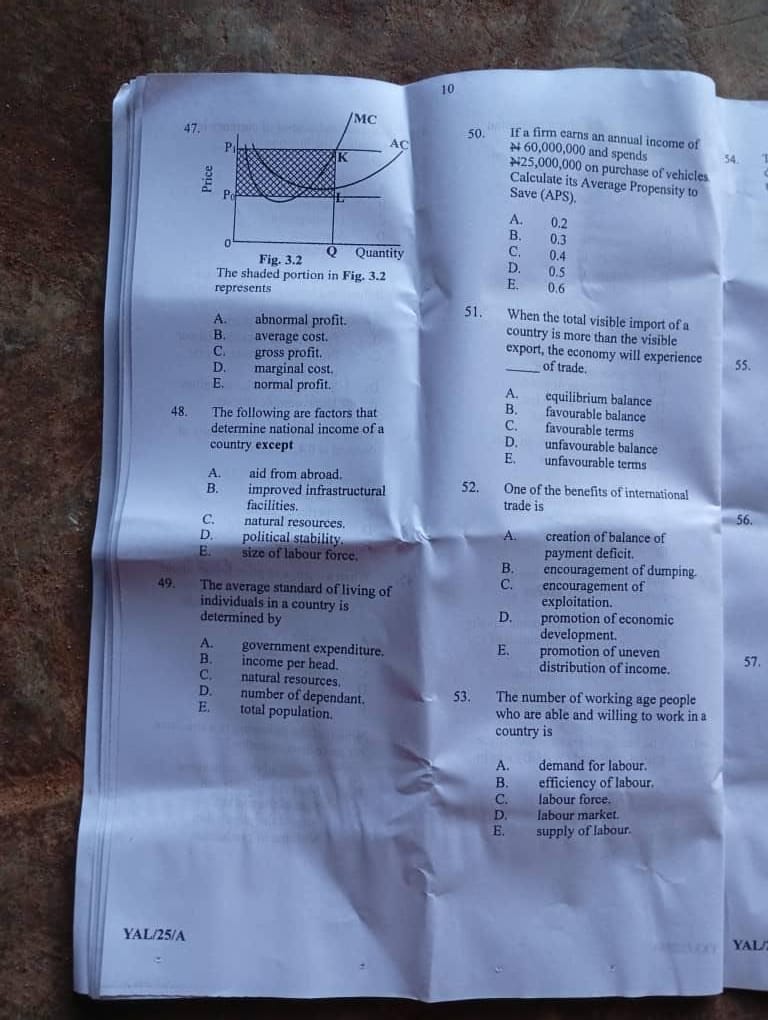

41-50: DACBEBAABE

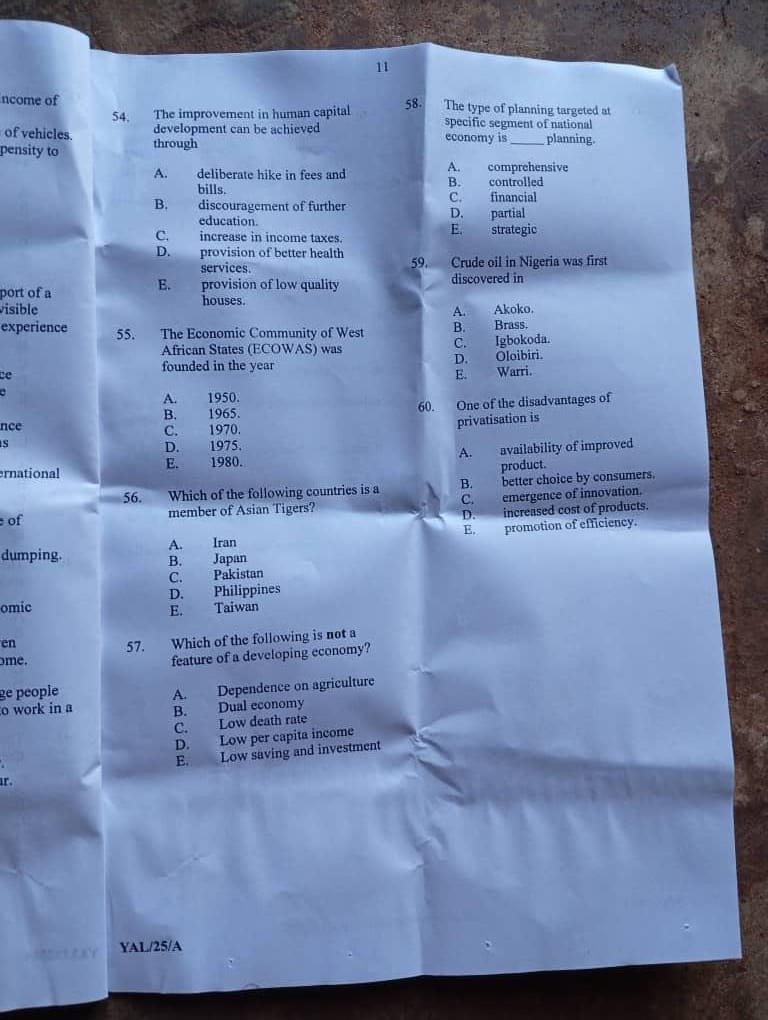

51-60: DDCDDECDDD

(WITH NUMBERING)

1.B 2.E 3.C 4.E 5.B 6.E 7.B 8.C 9.E 10.D

11.C 12.B 13.E 14.C 15.E 16.C 17.E 18.D 19.E 20.C

21.C 22.C 23.C 24.D 25.D 26.D 27.E 28.C 29.B 30.B

31.C 32.A 33.D 34.A 35.C 36.D 37.A 38.D 39.D 40.D

41.D 42.A 43.C 44.B 45.E 46.B 47.A 48.A 49.B 50.E

51.D 52.D 53.C 54.D 55.D 56.E 57.C 58.D 59.D 60.D

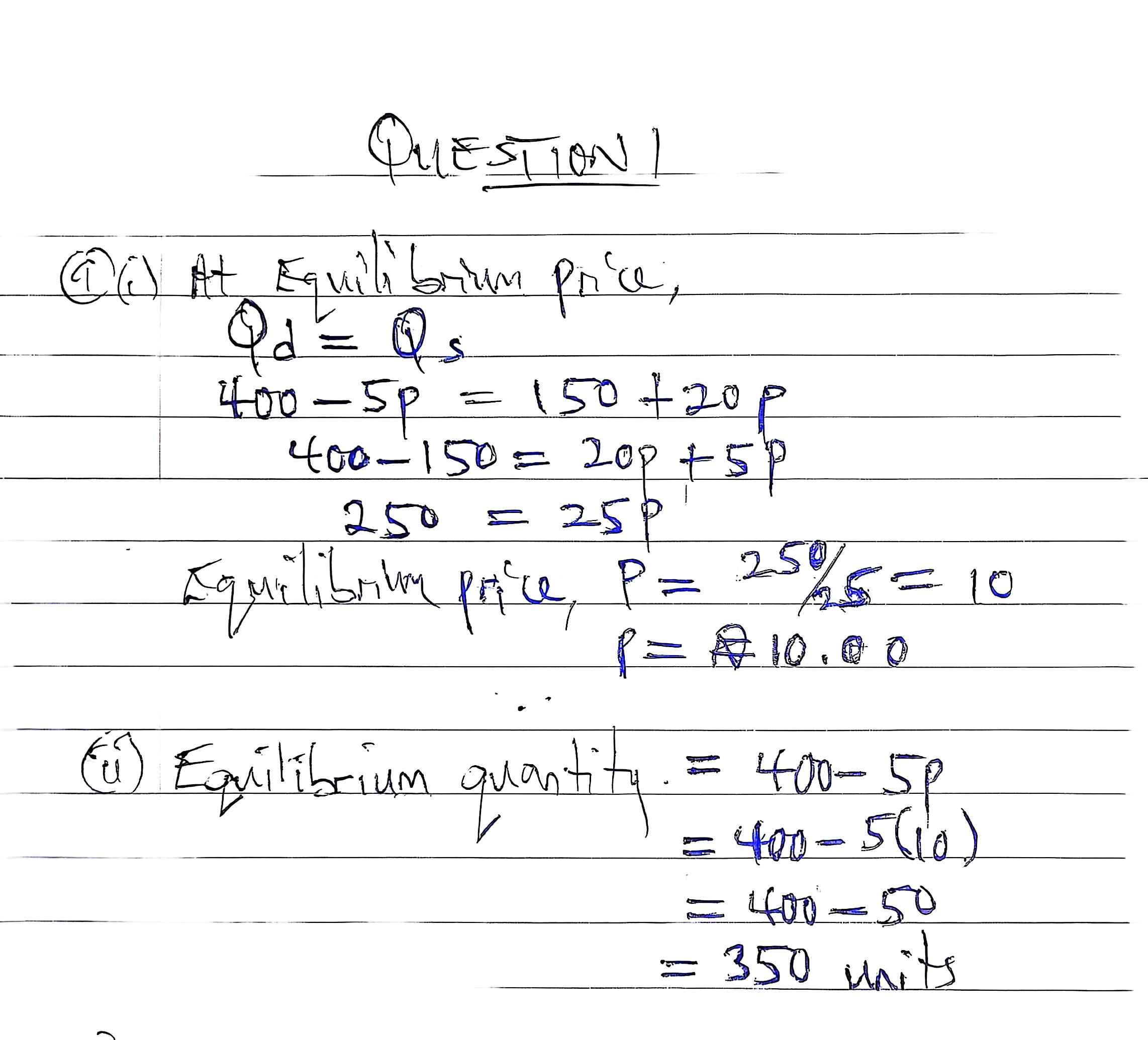

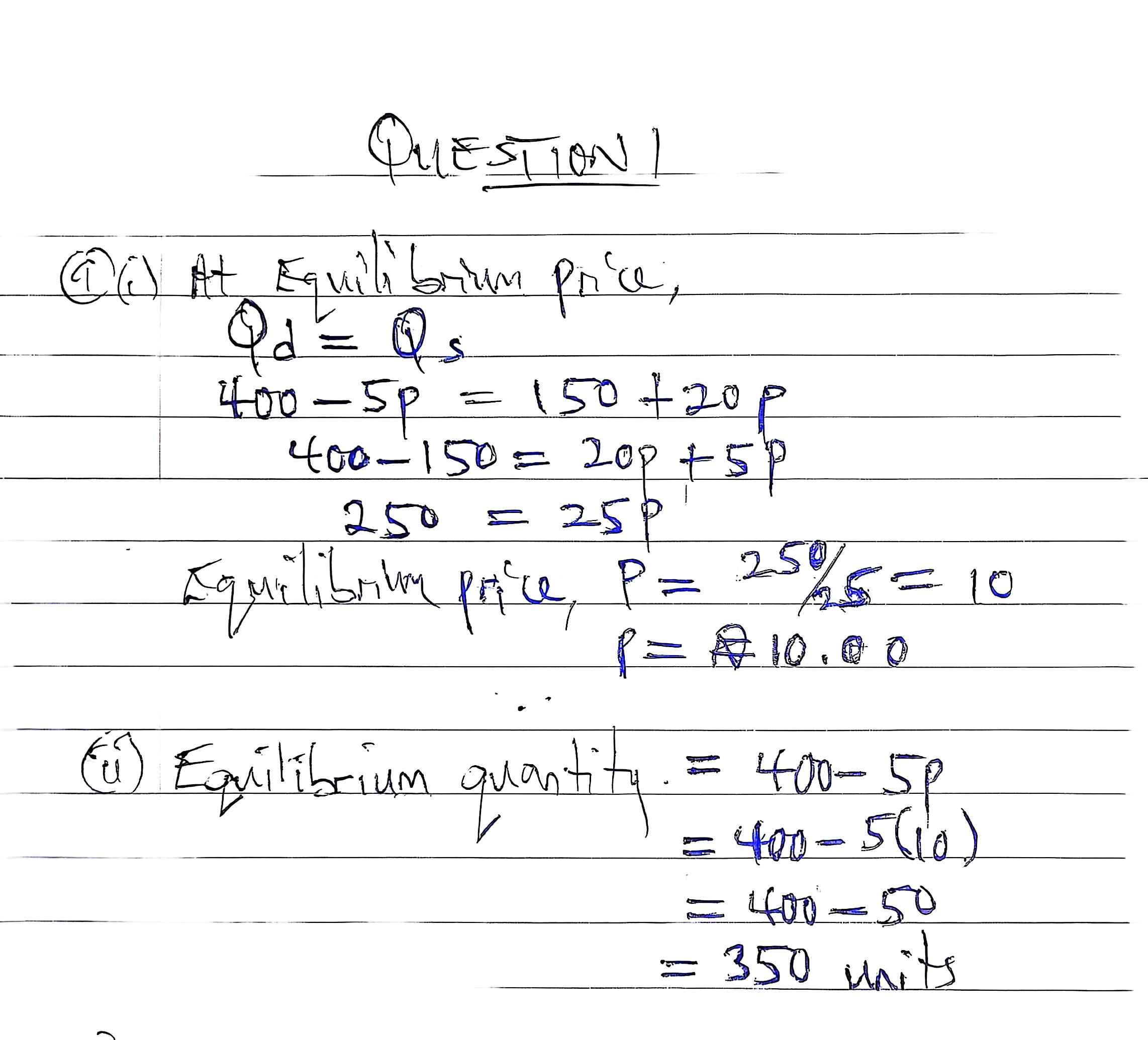

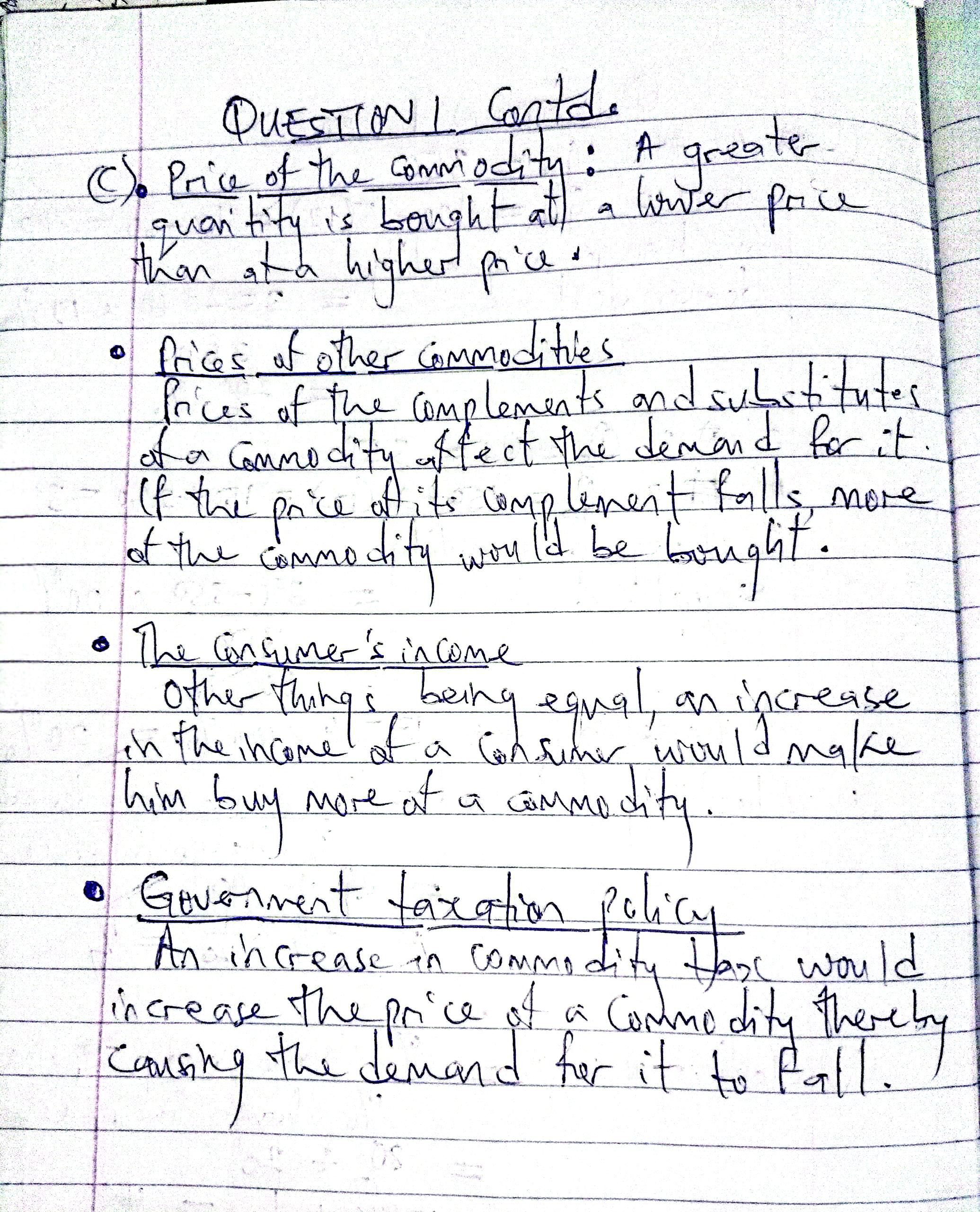

(1)

(PLEASE NOTE: 1bi and 1bii updated)

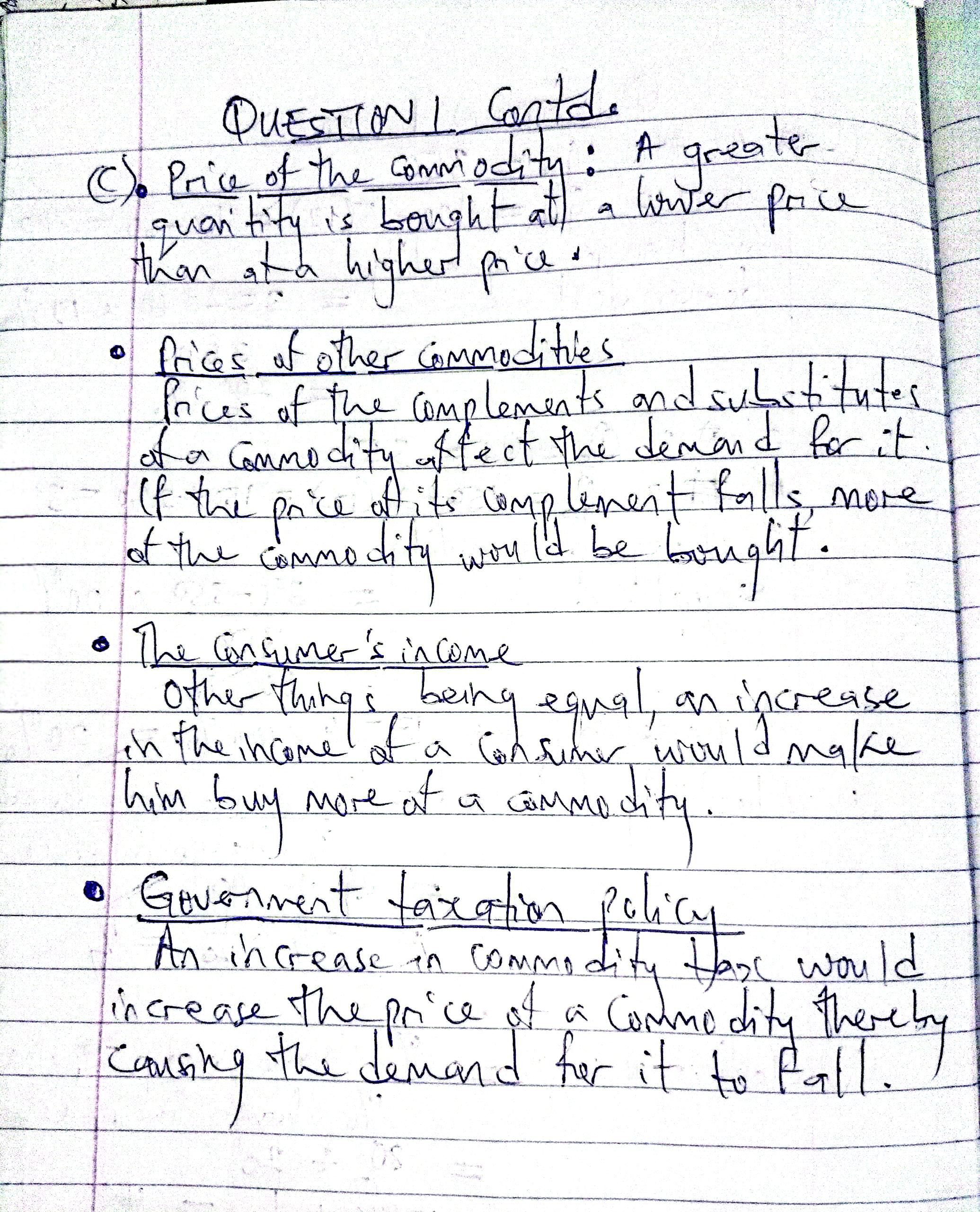

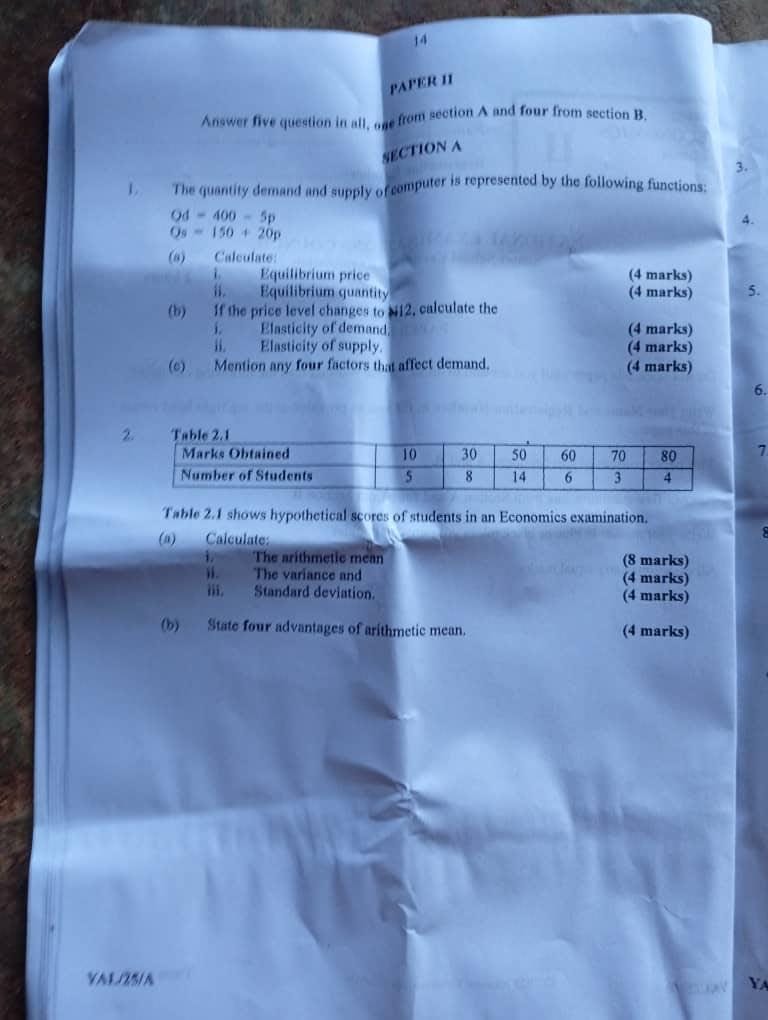

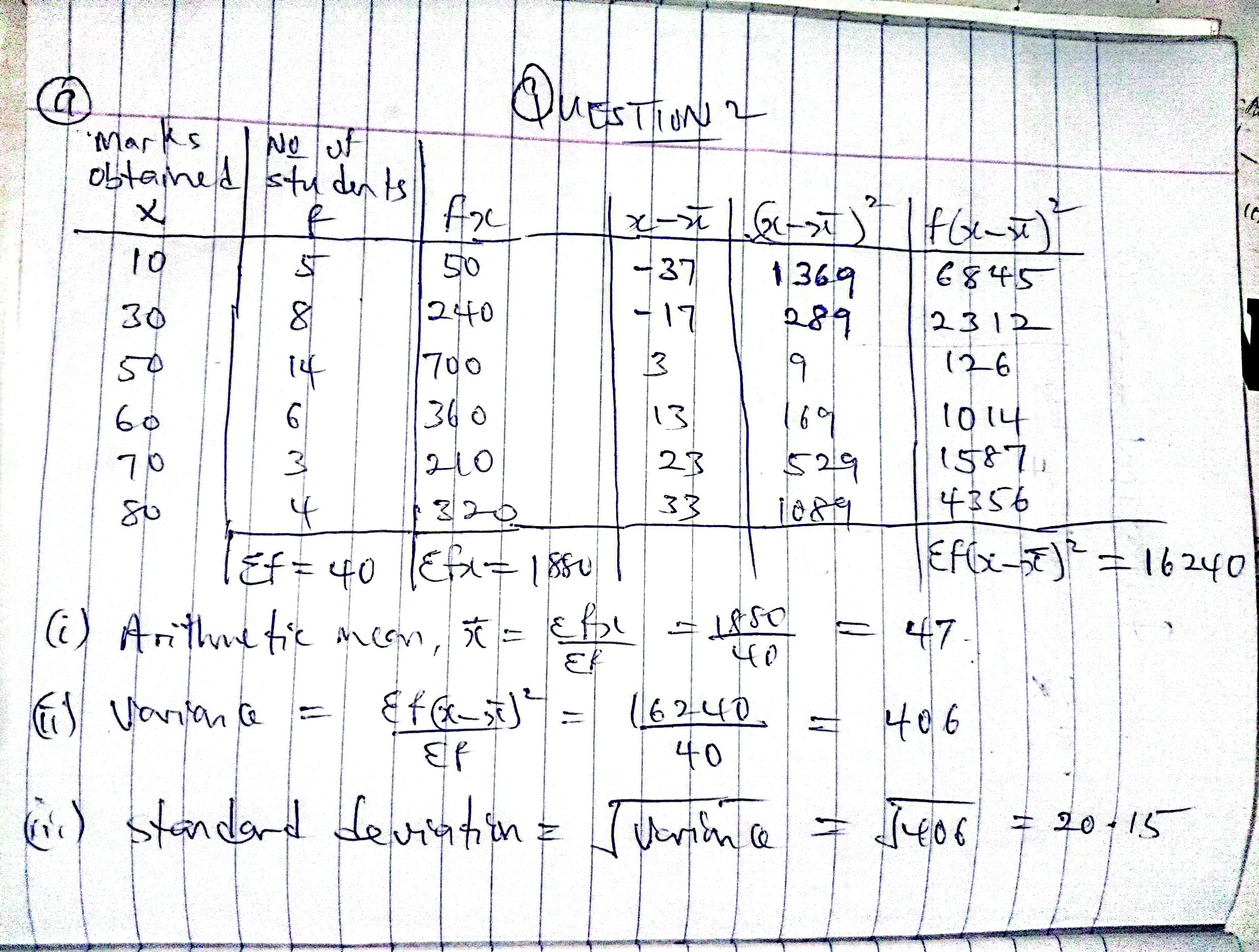

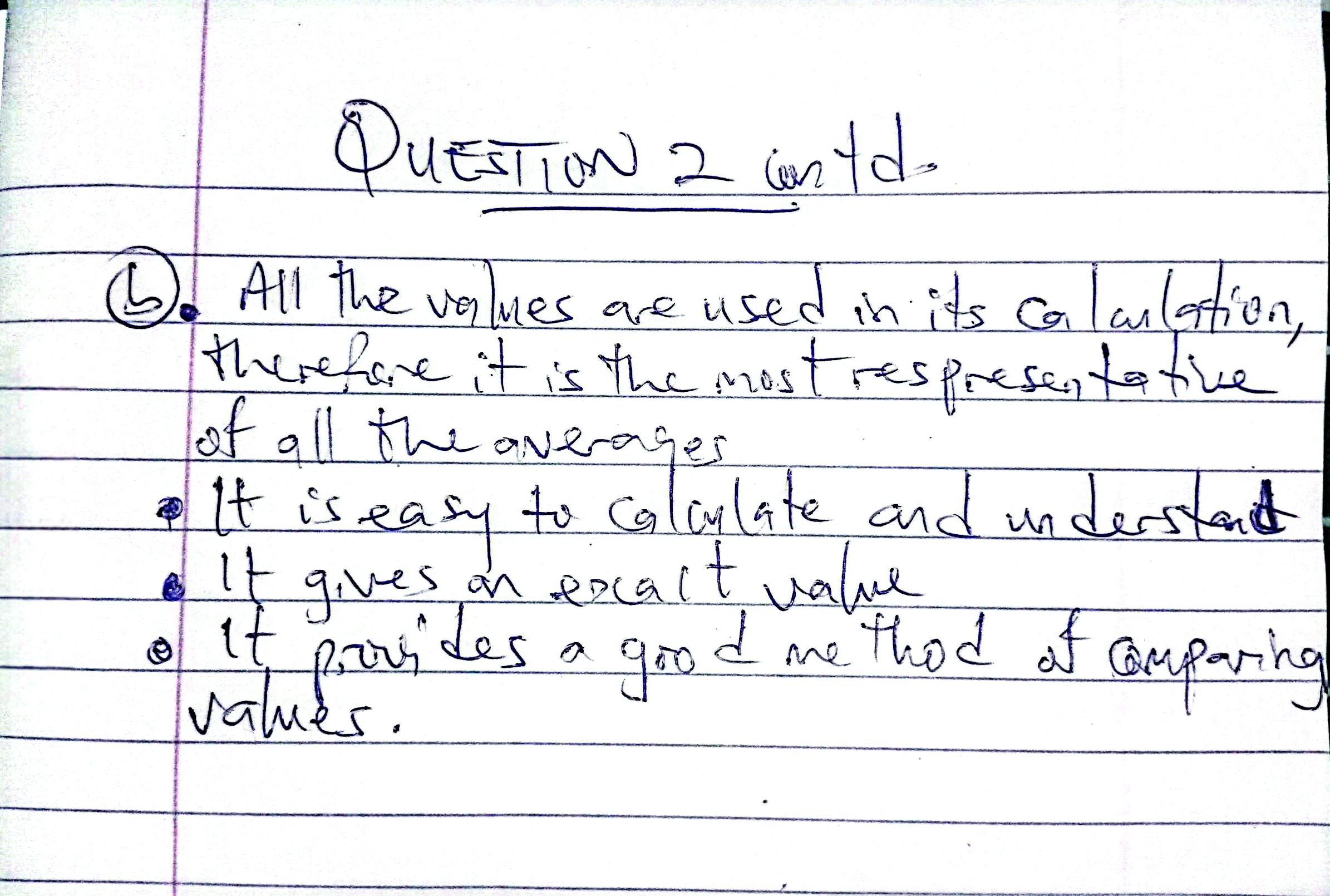

(2)

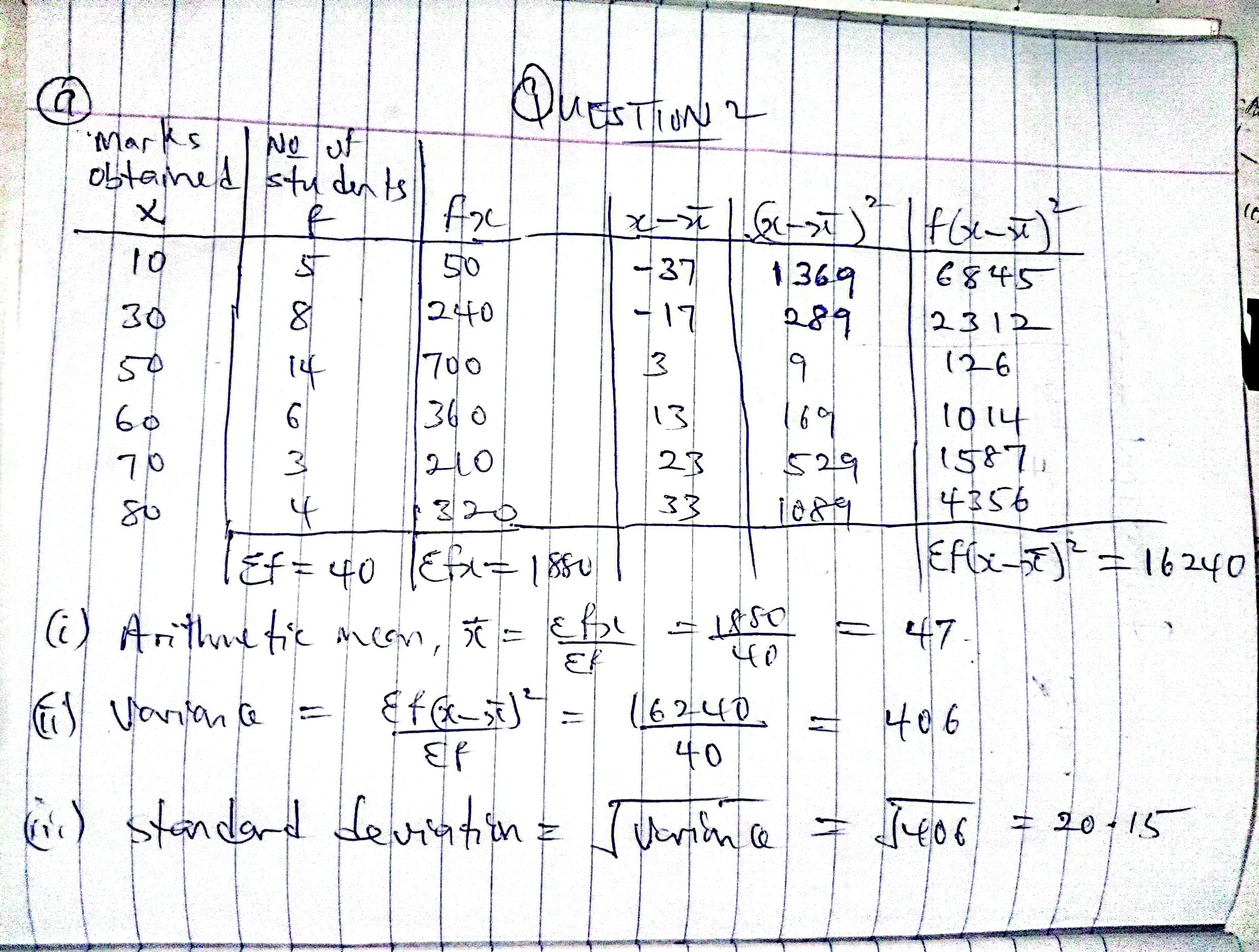

(3a)

(i) The Transaction Motive: This refers to the need to hold money for day-to-day spending. People and businesses require money to carry out regular transactions such as buying food, paying transport fares, paying salaries, or purchasing raw materials. Since most income is received periodically (e.g., monthly or weekly), individuals and firms keep money on hand to meet these regular expenses between one income period and the next.

(ii) The Precautionary Motive: This is the motive for holding money to cater for unexpected situations or emergencies. People save or keep money to handle unforeseen events such as illness, accidents, job loss, or urgent repair needs. Firms may also hold money to deal with unexpected drops in sales or sudden increases in production costs. The precautionary motive provides financial security in uncertain circumstances.

(iii) The Speculative Motive: This refers to holding money with the aim of taking advantage of future investment opportunities. People or businesses may hold back from investing in financial assets like bonds or shares if they expect the prices of these assets to fall, which would allow them to buy later at a cheaper rate. This motive is influenced by interest rates, when interest rates are low, people prefer to hold money rather than invest. But when interest rates are high, they are more likely to invest to earn returns.

(3b)

(PICK ANY FOUR)

(i) It leads to loss of interest or investment income.

(ii) It exposes the holder to the effects of inflation.

(iii) It encourages impulse or unnecessary spending.

(iv) It results in idle capital or low productivity.

(v) It increases the risk of theft or loss.

(vi) It indicates poor financial planning

(4a)

(PICK ANY TWO)

(i) In capitalism, the means of production such as land, industries, and capital are owned by private individuals, while in socialism, these are owned and controlled by the government on behalf of the people.

(ii) The main aim of capitalism is to make profit for individuals or companies, but in socialism, the aim is to ensure equal distribution of wealth and promote the welfare of all citizens.

(iii) Capitalism operates with minimal government interference in economic activities, while socialism involves active government participation and control in the planning and running of the economy.

(iv) Capitalism usually results in unequal distribution of wealth, where the rich get richer and the poor remain poor, but socialism seeks to reduce this gap by distributing wealth more equally among the people.

(v) In a capitalist system, there is open competition among businesses which leads to innovation and efficiency, while in socialism, the government controls production, so there is little or no competition.

(vi) Capitalism provides a wide range of choices to consumers due to many private producers, but in socialism, consumer choice may be limited because the government decides what is produced.

(4b)

(PICK ANY TWO)

(i) Private ownership of property: In a free market economy, individuals and private businesses have the right to own and control property, land, and other means of production. The government does not interfere with private ownership, and people can buy, sell, or transfer property as they wish.

(ii) Profit motive: The driving force of economic activities in a free market system is the desire to make profit. Producers and investors engage in business activities mainly to earn profits, and this motivates innovation and efficiency.

(iii) Freedom of choice:

Both consumers and producers enjoy the freedom to make their own choices. Consumers decide what to buy based on their needs and preferences, while producers choose what to produce and how to produce it, depending on what is profitable.

(iv) Competition: There is healthy competition among producers and sellers in the market. This leads to better quality goods and services, lower prices, and improved customer service, as each producer tries to attract more buyers

(v) Minimal government interference:

The government’s role in a free market economy is limited to maintaining law and order, protecting property rights, and enforcing contracts. It does not interfere directly in business decisions or price controls.

(vi) Consumer sovereignty:

Consumers have the power to influence what is produced in the market. Producers respond to consumer demands, and if a product is not in demand, it will likely not be produced.

(vii) Unequal distribution of income and wealth: Since individuals are rewarded based on their efforts, skills, and resources, a free market economy often results in economic inequality. The rich may continue to get richer, while the poor may have limited access to opportunities.

(4c)

(PICK ANY FOUR)

(i) Workers may lack motivation to be efficient because rewards are not based on performance.

(ii) Government-owned businesses are often inefficient due to lack of competition and profit motive.

(iii) Consumers have limited choices because the government controls what is produced.

(iv) Excessive government control reduces freedom as individuals cannot freely make economic decisions.

(v) High taxes are common in socialism to fund free public services and welfare.

(vi) Innovation is discouraged since individuals are not rewarded for new ideas.

(vii) It may lead to corruption and abuse of power because the government controls most resources.

(5a)

Formation: A co-operative society is formed when individuals with common social or economic interests voluntarily come together, pool their resources, and register under the Co-operative Societies Act to gain legal recognition While a limited liability company is formed by individuals or corporate bodies who register with the Corporate Affairs Commission (CAC) under the Companies and Allied Matters Act (CAMA), using legal documents such as the Memorandum and Articles of Association.

(5b)

Management: A co-operative society is democratically managed by an elected committee chosen from among the members, with each member having equal voting power, regardless of their capital contribution While a limited liability company is managed by a board of directors appointed by shareholders, and voting power is based on the number of shares held.

(5c)

Profits: In a co-operative society, profits which is referred to as surplus, are shared among members based on their level of patronage, and part of the surplus is usually retained for future use While in a limited liability company, profits are distributed as dividends to shareholders in proportion to the number of shares they hold.

(5d)

Rights of Members/Shareholders: Members of a co-operative society have equal rights, including one vote per person and access to the society’s services and surplus

While shareholders in a limited liability company enjoy rights based on the quantity of shares held, such as voting, receiving dividends, and transferring ownership of shares.

(6)

(PICK ANY FIVE)

(i) Provision of Infrastructure: Government can boost industrial development by providing basic infrastructure such as good roads, stable electricity, water supply, and telecommunication networks. These facilities reduce the cost of production, improve efficiency, and attract both local and foreign investors to establish industries.

(ii) Tax Reliefs and Holidays: The government can grant tax holidays or reduce tax rates for new or struggling industries. This encourages entrepreneurs to invest in manufacturing, knowing that they will enjoy temporary relief from certain taxes, such as company income tax or import duties on machinery.

(iii) Provision of Loans and Grants: Governments can promote industrialization by offering financial assistance to industrialists. This includes soft loans, long-term financing, and grants through agencies like the Bank of Industry (BOI). These funds help to establish, expand, or modernize industries.

(iv) Establishment of Industrial Estates: Creating designated industrial zones equipped with necessary facilities helps reduce startup and operational costs for manufacturers. These estates may include power supply, waste disposal systems, and security, making it easier and cheaper to run businesses.

(v) Implementation of Import Substitution Policies: By encouraging the local production of goods that are usually imported, government helps conserve foreign exchange and creates employment. Industries are supported through incentives to produce these goods locally.

(vi) Protection of Infant Industries: New or young industries may not be able to compete with large foreign companies. The government can protect them by placing tariffs on imported goods, limiting imports through quotas, or banning the importation of certain products to give local industries time to grow and mature.

(vii) Promotion of Technical Education and Skill Acquisition: For industries to thrive, skilled labour is essential. The government can invest in technical schools, vocational training centers, and entrepreneurship programs to develop human capital. This ensures industries have access to competent and skilled workers.

(7a)

(PICK ANY ONE)

Balance of payments is a detailed financial statement that records all economic transactions between a country and other countries within a specific time period, usually one year. It includes the inflow and outflow of money for exports and imports of goods and services, capital transfers, and financial investments. It shows whether a country is earning more from abroad or spending more on foreign transactions.

OR

Balance of payments is a record of all financial transactions made between a country and the rest of the world over a given period. It includes imports, exports, financial transfers, and capital flows.

(7b)

(PICK ANY FIVE)

(i) Promotion of Exports: To earn more foreign exchange, the government can support the export sector by providing export incentives, improving product quality, offering export financing, and organizing trade fairs abroad. This helps increase the country’s foreign earnings and corrects deficits.

(ii) Import Restrictions: By placing high tariffs, quotas, or outright bans on the importation of non-essential and luxury goods, the government reduces foreign exchange outflow. This makes more funds available for essential imports and reduces pressure on the balance of payments.

(iii) Currency Devaluation: Devaluation involves officially lowering the value of a country’s currency in relation to others. This makes locally produced goods cheaper for foreigners and encourages exports, while making imports more expensive, thus reducing their demand.

(iv) Securing Foreign Loans and Grants: To temporarily manage balance of payments deficits, the government can seek foreign aid, grants, or loans from international bodies like the IMF or World Bank. These funds help stabilize the economy while long-term measures are implemented.

(v) Encouragement of Foreign Direct Investment (FDI): Attracting investors from other countries brings in capital and foreign exchange. The government can achieve this by improving ease of doing business, ensuring political stability, and offering tax incentives to foreign investors.

(vi) Development of the Tourism Sector: Tourism can be a major source of foreign exchange. Government can develop tourist sites, provide security, and ease visa policies to attract international tourists. The money spent by tourists adds to the country’s foreign income.

(vii) Encouragement of Local Substitutes for Imported Goods: Producing domestically what was formerly imported reduces dependency on foreign goods and helps conserve foreign reserves. This can be achieved through support for local industries, use of local raw materials, and public awareness campaigns.

(8a)

(PICK ANY ONE)

Capital formation refers to the process of increasing the stock of real capital in an economy over time. It involves the production and accumulation of capital goods such as machinery, tools, buildings, and infrastructure which are used for further production of goods and services.

OR

Capital formation is the process of building up the capital stock of a country through investment in physical assets like machines, tools, roads, and buildings that are used for producing goods and services. It involves the conversion of savings into investments that help to improve the productive capacity of an economy.

(8b)

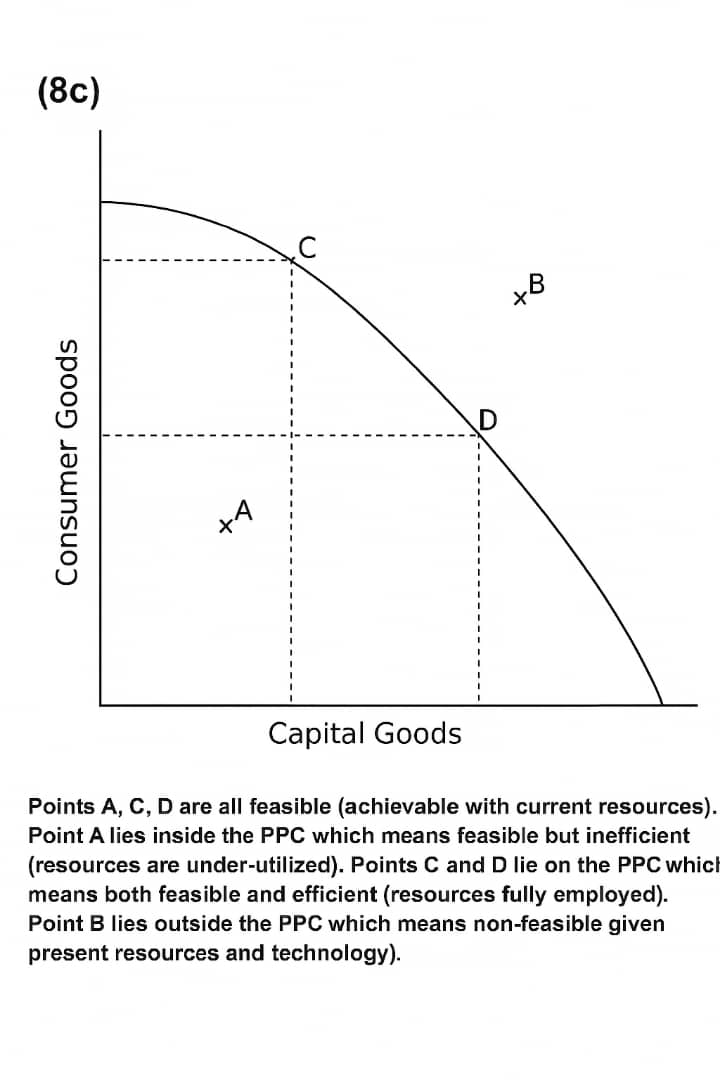

Opportunity cost refers to the value of the next best alternative that is given up when a choice is made. In the context of the Production Possibility Curve (PPC), opportunity cost is illustrated by the trade-offs that occur when resources are allocated to produce one good or service over another.

As you move along the PPC, producing more of one good means producing less of another. The opportunity cost is the amount of the other good that is sacrificed. The slope of the PPC represents the opportunity cost of producing one good in terms of the other.

(8c)

(9a)

Debt Servicing: Debt servicing is the regular payment of interest and repayment of borrowed funds by a government. It includes both internal and external debts. When a country spends too much revenue on servicing debts, it reduces funds available for development. For example, if Nigeria pays billions yearly to settle loans from the World Bank, it may delay projects in health and education. This can worsen living standards and increase poverty.

OR

Debt servicing means settling interest and principal on loans borrowed by a government, especially from international bodies like IMF and foreign governments. It becomes a problem when a large share of national income is used for repayment. For instance, if Nigeria uses 40% of its revenue to service debt, little remains for sectors like infrastructure and education. This limits economic growth and increases dependency on further loans.

(9b)

(PICK ANY ONE)

Gross National Product:

Gross National Product is the total value of final goods and services produced by a country’s citizens both at home and abroad in a year. It includes income earned by Nigerians overseas but excludes income made by foreigners in Nigeria. For example, a Nigerian company operating in the UK adds to Nigeria’s GNP. It helps measure the overall economic strength and productivity of a nation’s citizens.

OR

Gross National Product (GNP) is a broad measure of a country’s economic output. It accounts for the value of goods and services produced by citizens, no matter where they are in the world. For example, if a Nigerian doctor works in Canada and sends money home, it counts in Nigeria’s GNP. Foreign companies operating in Nigeria are excluded. GNP shows national income and helps assess living standards.

(9c)

(PICK ANY ONE)

Disinflation:

Disinflation is a slowdown in the rate of inflation over time. It means prices still rise but at a reduced rate. For example, if Nigeria’s inflation rate drops from 20% to 12%, that’s disinflation. It usually results from government actions like reducing public spending or tightening money supply. Disinflation signals improved price stability, unlike deflation, which means prices are actually falling across the economy.

OR

Disinflation occurs when inflation is decreasing gradually, although prices continue to rise. It is often seen when governments apply measures such as raising interest rates or cutting expenditures to control the economy. For example, if inflation falls from 15% to 9%, it is disinflation. It’s different from deflation, where prices drop. Disinflation is a positive sign that inflation is being managed but not yet eliminated.

(9d)

(PICK ANY ONE)

Surplus Budget:

A surplus budget occurs when projected government revenue exceeds estimated expenditure during a fiscal year. For instance, if Nigeria plans to earn ₦20 trillion and spend ₦17 trillion, there’s a ₦3 trillion surplus. Such a budget helps reduce national debt and inflation. However, if continued for too long, it might reduce investment in key sectors like education and infrastructure, slowing economic development.

OR

A surplus budget happens when government income is higher than its planned spending. This extra fund can be used to settle debts or save for the future. For example, if Nigeria generates ₦15 trillion but only plans to spend ₦12 trillion, there is a ₦3 trillion surplus. Though helpful for controlling inflation, excessive surpluses may limit growth if key sectors don’t get enough funding.

(9e)

(PICK ANY ONE)

Poverty Alleviation:

Poverty alleviation includes programmes and policies aimed at reducing the number of people living in poverty. In Nigeria, examples include NAPEP and Conditional Cash Transfer (CCT), which help provide financial aid, job creation, and skill acquisition. These efforts aim to improve access to food, education, and healthcare, raising living standards and promoting economic equality for disadvantaged citizens.

OR

Poverty alleviation refers to targeted efforts by government or NGOs to reduce poverty and improve lives. It includes job creation, training, and welfare programmes. For instance, N-Power trains youth and offers stipends to support livelihoods. Such measures help people become self-reliant, reduce unemployment, and promote inclusive growth by ensuring the poor have access to basic needs like shelter, food, and education.

(10a)

(PICK ANY ONE)

Localisation of industries refers to the concentration of many firms or businesses producing similar or related products in a particular geographical area or location. It means that industries involved in the same line of production are sited close to one another within the same region or town. This is is usually influenced by factors such as availability of raw materials, skilled labour, good transportation network, nearness to market, and government policies.

OR

Localisation of industries is the siting or concentration of several firms producing similar or related products in a particular area or region. It means that industries of the same type are located close to each other, often to take advantage of certain benefits such as cheap raw materials, availability of labour, good transportation, or access to markets. This allows firms to share common services and facilities, reduce production costs, and improve efficiency through specialization. It also leads to the development of industrial towns or zones.

(10b)

ADVANTAGES:

(PICK ANY THREE)

(i) Economies of Scale: When many firms producing similar goods are located in the same area, they enjoy economies of scale. This means they can share services like electricity, water supply, transportation, and even suppliers. The joint use of these facilities reduces the cost of production per unit, leading to higher profitability and efficiency for the firms.

(ii) Availability of Skilled Labour: Localisation encourages the concentration of workers who are specially trained or experienced in that particular industry. Over time, such areas develop a pool of skilled labour that is readily available to employers. This improves productivity and leads to better quality of goods and services produced.

(iii) Development of Ancillary Industries: When an industry localises, it attracts support services such as repair workshops, packaging firms, banking, transportation, and other small businesses that rely on the main industry. These ancillary industries help to support and sustain the main industries, creating more jobs and boosting local economic growth.

(iv) Specialization and Efficiency: Firms located close together often specialize in different stages of production. For example, one firm may focus on raw material processing while another handles packaging. This division of labour increases efficiency, improves output, and reduces duplication of efforts.

(v) Urban and Industrial Development: As industries concentrate in one area, there is a corresponding development of infrastructure such as roads, housing, communication, and electricity. This transforms the area into an industrial hub, promotes urbanization, and enhances economic activities in the region.

DISADVANTAGES:

(PICK ANY TWO)

(i) Overcrowding and Congestion: The concentration of many industries in one area can lead to overcrowding. This puts pressure on housing, roads, water supply, and other public services. As a result, traffic congestion, poor sanitation, and a high cost of living may occur.

(ii) Environmental Pollution: Localisation leads to heavy industrial activity in one area, which can result in serious environmental problems. These include air and water pollution, improper waste disposal, and noise pollution, which may negatively affect the health of workers and residents.

(iii) Regional Imbalance: When industries are concentrated in only a few regions, other areas of the country remain underdeveloped. This creates uneven development, where one part of the country is industrially advanced while others lack basic infrastructure and job opportunities.

(iv) Risk of Industrial Decline: If the main industry in a localised area suffers a downturn due to a fall in demand or shortage of raw materials, the entire area may be affected. Since the economy of the region depends on one industry, its collapse may lead to mass unemployment and economic hardship.

(11a)

(PICK ANY TWO)

(i) A budget deficit occurs when a government’s expenditure exceeds its revenue, while a budget surplus occurs when a government’s revenue exceeds its expenditure.

(ii) Budget deficit often leads to borrowing or debt accumulation, while a budget surplus allows for savings or debt repayment.

(iii) Budget deficits can be used to stimulate economic growth during a recession, while surplus budgets are used to control inflation.

(iv) Budget deficits can cause currency depreciation due to borrowing, while surplus budgets can improve investor confidence and currency stability.

(11b)

(PICK ANY FOUR)

(i) Capital Formation: The stock exchange provides a platform for companies to raise long-term capital by issuing shares and bonds to the public. This allows businesses to obtain necessary funds for expansion, innovation, and investment in productive activities. It helps mobilize savings from individuals and institutions and directs them into sectors that promote economic development and industrial growth.

(ii) Provides Liquidity: One major function of the stock exchange is to provide liquidity to investors. It allows individuals and institutions to easily convert their investments (shares, bonds, etc.) into cash by selling them when needed. This flexibility encourages more people to invest, knowing they can retrieve their funds at any time through market transactions without much delay.

(iii) Pricing of Securities: The stock exchange facilitates the determination of the market price of securities based on the forces of demand and supply. Through continuous trading, the true value of shares and other instruments is revealed. This transparent pricing helps investors make informed decisions and also signals the performance and profitability of companies to the general public.

(iv) Encourages Investment: By providing a safe, regulated, and organized platform for buying and selling securities, the stock exchange encourages the public to invest their surplus funds rather than keeping them idle. This investment culture leads to increased capital availability, wealth creation, and a more active participation in national economic growth.

(v) Aids Government Financing: Governments can raise funds for development projects through the sale of bonds and treasury bills on the stock exchange. These funds are used to finance infrastructure like roads, schools, and hospitals. It provides an alternative to excessive borrowing from foreign sources and helps manage public debt more effectively within a local framework.

(vi) Promotes Economic Growth: The stock exchange channels funds from savers to firms and government institutions that require capital for productive purposes. This flow of investment into various sectors leads to job creation, expansion of businesses, increased output, and overall economic growth. It is a key component in a country’s financial development and industrialization.

(vii) Protects Investors: The stock exchange operates under strict rules and regulations enforced by bodies like the Securities and Exchange Commission (SEC). These regulations protect investors from fraud, insider trading, and manipulation. By ensuring fairness and transparency in trading activities, it builds investor confidence and maintains order in the capital market.

(viii) Indicator of Economic Performance: The performance of the stock exchange often reflects the overall health of the economy. A bullish (rising) market suggests investor confidence and economic growth, while a bearish (falling) market may signal economic downturn or uncertainty. Policymakers and economists use stock exchange trends to forecast and assess the country’s economic outlook.

(12)

(PICK ANY FIVE)

(i) Improved Working Conditions: The government can reduce brain drain by providing better working conditions for professionals, especially in sectors like healthcare, education, and technology. This includes equipping workplaces with modern facilities, reducing workload stress, and ensuring safety. When professionals have a comfortable and efficient environment, they are more likely to remain in the country rather than seek opportunities abroad.

(ii) Attractive Remuneration Packages: Offering competitive salaries, allowances, and incentives can discourage professionals from leaving Nigeria. Many skilled workers travel abroad due to poor wages. If the government ensures regular and attractive pay, coupled with performance bonuses and pensions, professionals will feel valued and financially secure enough to build their careers within the country rather than seeking greener pastures elsewhere.

(iii) Investment in Education and Research: Government investment in education and research institutions can help retain talent. When students and academics are exposed to world-class facilities, funded research projects, and innovative learning environments, they are encouraged to stay. Scholarships, grants, and partnerships with international institutions will also give professionals reasons to remain and grow their careers within the Nigerian system.

(iv) Provision of Social Amenities: Improving public infrastructure such as electricity, water supply, housing, transportation, and healthcare will enhance citizens’ quality of life. Many professionals migrate because of poor living conditions. If basic amenities are made reliable and accessible, people will be more likely to remain in the country, as they can enjoy a decent standard of living without relocating.

(v) Political Stability and Security: A stable political environment and enhanced national security can reduce brain drain. Professionals prefer countries where they and their families are safe. Government must address insecurity, reduce corruption, and promote good governance. When citizens are confident in the country’s leadership and safety, they are more likely to stay and contribute to national development.

(vi) Creation of Job Opportunities: The government should focus on job creation in sectors like ICT, healthcare, engineering, and education. Establishing youth empowerment programs, supporting startups, and investing in industries can provide more employment opportunities for skilled Nigerians. When people can find meaningful and rewarding work within the country, the desire to travel abroad for job opportunities will greatly reduce.

(vii) Reintegration Programs for Returnees: The government can create programs to support Nigerians who wish to return home after working abroad. These may include tax reliefs, housing schemes, grants, or guaranteed job placements. Such reintegration efforts will encourage professionals to bring their skills and experiences back home, reducing brain drain and contributing positively to national growth and innovation.

Monday 14th July, 2025

Economics (Objective & Essay) — 10:00 am – 1:00 pm

ECONOMICS OBJ:

1-10: BECEBEBCED

11-20: CBECECEDEC

21-30: CCCDDDECBB

31-40: CADACDADDD

41-50: DACBEBAABE

51-60: DDCDDECDDD

(WITH NUMBERING)

1.B 2.E 3.C 4.E 5.B 6.E 7.B 8.C 9.E 10.D

11.C 12.B 13.E 14.C 15.E 16.C 17.E 18.D 19.E 20.C

21.C 22.C 23.C 24.D 25.D 26.D 27.E 28.C 29.B 30.B

31.C 32.A 33.D 34.A 35.C 36.D 37.A 38.D 39.D 40.D

41.D 42.A 43.C 44.B 45.E 46.B 47.A 48.A 49.B 50.E

51.D 52.D 53.C 54.D 55.D 56.E 57.C 58.D 59.D 60.D

(1)

(PLEASE NOTE: 1bi and 1bii updated)

(2)

(3a)

(i) The Transaction Motive: This refers to the need to hold money for day-to-day spending. People and businesses require money to carry out regular transactions such as buying food, paying transport fares, paying salaries, or purchasing raw materials. Since most income is received periodically (e.g., monthly or weekly), individuals and firms keep money on hand to meet these regular expenses between one income period and the next.

(ii) The Precautionary Motive: This is the motive for holding money to cater for unexpected situations or emergencies. People save or keep money to handle unforeseen events such as illness, accidents, job loss, or urgent repair needs. Firms may also hold money to deal with unexpected drops in sales or sudden increases in production costs. The precautionary motive provides financial security in uncertain circumstances.

(iii) The Speculative Motive: This refers to holding money with the aim of taking advantage of future investment opportunities. People or businesses may hold back from investing in financial assets like bonds or shares if they expect the prices of these assets to fall, which would allow them to buy later at a cheaper rate. This motive is influenced by interest rates, when interest rates are low, people prefer to hold money rather than invest. But when interest rates are high, they are more likely to invest to earn returns.

(3b)

(PICK ANY FOUR)

(i) It leads to loss of interest or investment income.

(ii) It exposes the holder to the effects of inflation.

(iii) It encourages impulse or unnecessary spending.

(iv) It results in idle capital or low productivity.

(v) It increases the risk of theft or loss.

(vi) It indicates poor financial planning

(4a)

(PICK ANY TWO)

(i) In capitalism, the means of production such as land, industries, and capital are owned by private individuals, while in socialism, these are owned and controlled by the government on behalf of the people.

(ii) The main aim of capitalism is to make profit for individuals or companies, but in socialism, the aim is to ensure equal distribution of wealth and promote the welfare of all citizens.

(iii) Capitalism operates with minimal government interference in economic activities, while socialism involves active government participation and control in the planning and running of the economy.

(iv) Capitalism usually results in unequal distribution of wealth, where the rich get richer and the poor remain poor, but socialism seeks to reduce this gap by distributing wealth more equally among the people.

(v) In a capitalist system, there is open competition among businesses which leads to innovation and efficiency, while in socialism, the government controls production, so there is little or no competition.

(vi) Capitalism provides a wide range of choices to consumers due to many private producers, but in socialism, consumer choice may be limited because the government decides what is produced.

(4b)

(PICK ANY TWO)

(i) Private ownership of property: In a free market economy, individuals and private businesses have the right to own and control property, land, and other means of production. The government does not interfere with private ownership, and people can buy, sell, or transfer property as they wish.

(ii) Profit motive: The driving force of economic activities in a free market system is the desire to make profit. Producers and investors engage in business activities mainly to earn profits, and this motivates innovation and efficiency.

(iii) Freedom of choice:

Both consumers and producers enjoy the freedom to make their own choices. Consumers decide what to buy based on their needs and preferences, while producers choose what to produce and how to produce it, depending on what is profitable.

(iv) Competition: There is healthy competition among producers and sellers in the market. This leads to better quality goods and services, lower prices, and improved customer service, as each producer tries to attract more buyers

(v) Minimal government interference:

The government’s role in a free market economy is limited to maintaining law and order, protecting property rights, and enforcing contracts. It does not interfere directly in business decisions or price controls.

(vi) Consumer sovereignty:

Consumers have the power to influence what is produced in the market. Producers respond to consumer demands, and if a product is not in demand, it will likely not be produced.

(vii) Unequal distribution of income and wealth: Since individuals are rewarded based on their efforts, skills, and resources, a free market economy often results in economic inequality. The rich may continue to get richer, while the poor may have limited access to opportunities.

(4c)

(PICK ANY FOUR)

(i) Workers may lack motivation to be efficient because rewards are not based on performance.

(ii) Government-owned businesses are often inefficient due to lack of competition and profit motive.

(iii) Consumers have limited choices because the government controls what is produced.

(iv) Excessive government control reduces freedom as individuals cannot freely make economic decisions.

(v) High taxes are common in socialism to fund free public services and welfare.

(vi) Innovation is discouraged since individuals are not rewarded for new ideas.

(vii) It may lead to corruption and abuse of power because the government controls most resources.

(5a)

Formation: A co-operative society is formed when individuals with common social or economic interests voluntarily come together, pool their resources, and register under the Co-operative Societies Act to gain legal recognition While a limited liability company is formed by individuals or corporate bodies who register with the Corporate Affairs Commission (CAC) under the Companies and Allied Matters Act (CAMA), using legal documents such as the Memorandum and Articles of Association.

(5b)

Management: A co-operative society is democratically managed by an elected committee chosen from among the members, with each member having equal voting power, regardless of their capital contribution While a limited liability company is managed by a board of directors appointed by shareholders, and voting power is based on the number of shares held.

(5c)

Profits: In a co-operative society, profits which is referred to as surplus, are shared among members based on their level of patronage, and part of the surplus is usually retained for future use While in a limited liability company, profits are distributed as dividends to shareholders in proportion to the number of shares they hold.

(5d)

Rights of Members/Shareholders: Members of a co-operative society have equal rights, including one vote per person and access to the society’s services and surplus

While shareholders in a limited liability company enjoy rights based on the quantity of shares held, such as voting, receiving dividends, and transferring ownership of shares.

(6)

(PICK ANY FIVE)

(i) Provision of Infrastructure: Government can boost industrial development by providing basic infrastructure such as good roads, stable electricity, water supply, and telecommunication networks. These facilities reduce the cost of production, improve efficiency, and attract both local and foreign investors to establish industries.

(ii) Tax Reliefs and Holidays: The government can grant tax holidays or reduce tax rates for new or struggling industries. This encourages entrepreneurs to invest in manufacturing, knowing that they will enjoy temporary relief from certain taxes, such as company income tax or import duties on machinery.

(iii) Provision of Loans and Grants: Governments can promote industrialization by offering financial assistance to industrialists. This includes soft loans, long-term financing, and grants through agencies like the Bank of Industry (BOI). These funds help to establish, expand, or modernize industries.

(iv) Establishment of Industrial Estates: Creating designated industrial zones equipped with necessary facilities helps reduce startup and operational costs for manufacturers. These estates may include power supply, waste disposal systems, and security, making it easier and cheaper to run businesses.

(v) Implementation of Import Substitution Policies: By encouraging the local production of goods that are usually imported, government helps conserve foreign exchange and creates employment. Industries are supported through incentives to produce these goods locally.

(vi) Protection of Infant Industries: New or young industries may not be able to compete with large foreign companies. The government can protect them by placing tariffs on imported goods, limiting imports through quotas, or banning the importation of certain products to give local industries time to grow and mature.

(vii) Promotion of Technical Education and Skill Acquisition: For industries to thrive, skilled labour is essential. The government can invest in technical schools, vocational training centers, and entrepreneurship programs to develop human capital. This ensures industries have access to competent and skilled workers.

(7a)

(PICK ANY ONE)

Balance of payments is a detailed financial statement that records all economic transactions between a country and other countries within a specific time period, usually one year. It includes the inflow and outflow of money for exports and imports of goods and services, capital transfers, and financial investments. It shows whether a country is earning more from abroad or spending more on foreign transactions.

OR

Balance of payments is a record of all financial transactions made between a country and the rest of the world over a given period. It includes imports, exports, financial transfers, and capital flows.

(7b)

(PICK ANY FIVE)

(i) Promotion of Exports: To earn more foreign exchange, the government can support the export sector by providing export incentives, improving product quality, offering export financing, and organizing trade fairs abroad. This helps increase the country’s foreign earnings and corrects deficits.

(ii) Import Restrictions: By placing high tariffs, quotas, or outright bans on the importation of non-essential and luxury goods, the government reduces foreign exchange outflow. This makes more funds available for essential imports and reduces pressure on the balance of payments.

(iii) Currency Devaluation: Devaluation involves officially lowering the value of a country’s currency in relation to others. This makes locally produced goods cheaper for foreigners and encourages exports, while making imports more expensive, thus reducing their demand.

(iv) Securing Foreign Loans and Grants: To temporarily manage balance of payments deficits, the government can seek foreign aid, grants, or loans from international bodies like the IMF or World Bank. These funds help stabilize the economy while long-term measures are implemented.

(v) Encouragement of Foreign Direct Investment (FDI): Attracting investors from other countries brings in capital and foreign exchange. The government can achieve this by improving ease of doing business, ensuring political stability, and offering tax incentives to foreign investors.

(vi) Development of the Tourism Sector: Tourism can be a major source of foreign exchange. Government can develop tourist sites, provide security, and ease visa policies to attract international tourists. The money spent by tourists adds to the country’s foreign income.

(vii) Encouragement of Local Substitutes for Imported Goods: Producing domestically what was formerly imported reduces dependency on foreign goods and helps conserve foreign reserves. This can be achieved through support for local industries, use of local raw materials, and public awareness campaigns.

(8a)

(PICK ANY ONE)

Capital formation refers to the process of increasing the stock of real capital in an economy over time. It involves the production and accumulation of capital goods such as machinery, tools, buildings, and infrastructure which are used for further production of goods and services.

OR

Capital formation is the process of building up the capital stock of a country through investment in physical assets like machines, tools, roads, and buildings that are used for producing goods and services. It involves the conversion of savings into investments that help to improve the productive capacity of an economy.

(8b)

Opportunity cost refers to the value of the next best alternative that is given up when a choice is made. In the context of the Production Possibility Curve (PPC), opportunity cost is illustrated by the trade-offs that occur when resources are allocated to produce one good or service over another.

As you move along the PPC, producing more of one good means producing less of another. The opportunity cost is the amount of the other good that is sacrificed. The slope of the PPC represents the opportunity cost of producing one good in terms of the other.

(8c)

(9a)

Debt Servicing: Debt servicing is the regular payment of interest and repayment of borrowed funds by a government. It includes both internal and external debts. When a country spends too much revenue on servicing debts, it reduces funds available for development. For example, if Nigeria pays billions yearly to settle loans from the World Bank, it may delay projects in health and education. This can worsen living standards and increase poverty.

OR

Debt servicing means settling interest and principal on loans borrowed by a government, especially from international bodies like IMF and foreign governments. It becomes a problem when a large share of national income is used for repayment. For instance, if Nigeria uses 40% of its revenue to service debt, little remains for sectors like infrastructure and education. This limits economic growth and increases dependency on further loans.

(9b)

(PICK ANY ONE)

Gross National Product:

Gross National Product is the total value of final goods and services produced by a country’s citizens both at home and abroad in a year. It includes income earned by Nigerians overseas but excludes income made by foreigners in Nigeria. For example, a Nigerian company operating in the UK adds to Nigeria’s GNP. It helps measure the overall economic strength and productivity of a nation’s citizens.

OR

Gross National Product (GNP) is a broad measure of a country’s economic output. It accounts for the value of goods and services produced by citizens, no matter where they are in the world. For example, if a Nigerian doctor works in Canada and sends money home, it counts in Nigeria’s GNP. Foreign companies operating in Nigeria are excluded. GNP shows national income and helps assess living standards.

(9c)

(PICK ANY ONE)

Disinflation:

Disinflation is a slowdown in the rate of inflation over time. It means prices still rise but at a reduced rate. For example, if Nigeria’s inflation rate drops from 20% to 12%, that’s disinflation. It usually results from government actions like reducing public spending or tightening money supply. Disinflation signals improved price stability, unlike deflation, which means prices are actually falling across the economy.

OR

Disinflation occurs when inflation is decreasing gradually, although prices continue to rise. It is often seen when governments apply measures such as raising interest rates or cutting expenditures to control the economy. For example, if inflation falls from 15% to 9%, it is disinflation. It’s different from deflation, where prices drop. Disinflation is a positive sign that inflation is being managed but not yet eliminated.

(9d)

(PICK ANY ONE)

Surplus Budget:

A surplus budget occurs when projected government revenue exceeds estimated expenditure during a fiscal year. For instance, if Nigeria plans to earn ₦20 trillion and spend ₦17 trillion, there’s a ₦3 trillion surplus. Such a budget helps reduce national debt and inflation. However, if continued for too long, it might reduce investment in key sectors like education and infrastructure, slowing economic development.

OR

A surplus budget happens when government income is higher than its planned spending. This extra fund can be used to settle debts or save for the future. For example, if Nigeria generates ₦15 trillion but only plans to spend ₦12 trillion, there is a ₦3 trillion surplus. Though helpful for controlling inflation, excessive surpluses may limit growth if key sectors don’t get enough funding.

(9e)

(PICK ANY ONE)

Poverty Alleviation:

Poverty alleviation includes programmes and policies aimed at reducing the number of people living in poverty. In Nigeria, examples include NAPEP and Conditional Cash Transfer (CCT), which help provide financial aid, job creation, and skill acquisition. These efforts aim to improve access to food, education, and healthcare, raising living standards and promoting economic equality for disadvantaged citizens.

OR

Poverty alleviation refers to targeted efforts by government or NGOs to reduce poverty and improve lives. It includes job creation, training, and welfare programmes. For instance, N-Power trains youth and offers stipends to support livelihoods. Such measures help people become self-reliant, reduce unemployment, and promote inclusive growth by ensuring the poor have access to basic needs like shelter, food, and education.

(10a)

(PICK ANY ONE)

Localisation of industries refers to the concentration of many firms or businesses producing similar or related products in a particular geographical area or location. It means that industries involved in the same line of production are sited close to one another within the same region or town. This is is usually influenced by factors such as availability of raw materials, skilled labour, good transportation network, nearness to market, and government policies.

OR

Localisation of industries is the siting or concentration of several firms producing similar or related products in a particular area or region. It means that industries of the same type are located close to each other, often to take advantage of certain benefits such as cheap raw materials, availability of labour, good transportation, or access to markets. This allows firms to share common services and facilities, reduce production costs, and improve efficiency through specialization. It also leads to the development of industrial towns or zones.

(10b)

ADVANTAGES:

(PICK ANY THREE)

(i) Economies of Scale: When many firms producing similar goods are located in the same area, they enjoy economies of scale. This means they can share services like electricity, water supply, transportation, and even suppliers. The joint use of these facilities reduces the cost of production per unit, leading to higher profitability and efficiency for the firms.

(ii) Availability of Skilled Labour: Localisation encourages the concentration of workers who are specially trained or experienced in that particular industry. Over time, such areas develop a pool of skilled labour that is readily available to employers. This improves productivity and leads to better quality of goods and services produced.

(iii) Development of Ancillary Industries: When an industry localises, it attracts support services such as repair workshops, packaging firms, banking, transportation, and other small businesses that rely on the main industry. These ancillary industries help to support and sustain the main industries, creating more jobs and boosting local economic growth.

(iv) Specialization and Efficiency: Firms located close together often specialize in different stages of production. For example, one firm may focus on raw material processing while another handles packaging. This division of labour increases efficiency, improves output, and reduces duplication of efforts.

(v) Urban and Industrial Development: As industries concentrate in one area, there is a corresponding development of infrastructure such as roads, housing, communication, and electricity. This transforms the area into an industrial hub, promotes urbanization, and enhances economic activities in the region.

DISADVANTAGES:

(PICK ANY TWO)

(i) Overcrowding and Congestion: The concentration of many industries in one area can lead to overcrowding. This puts pressure on housing, roads, water supply, and other public services. As a result, traffic congestion, poor sanitation, and a high cost of living may occur.

(ii) Environmental Pollution: Localisation leads to heavy industrial activity in one area, which can result in serious environmental problems. These include air and water pollution, improper waste disposal, and noise pollution, which may negatively affect the health of workers and residents.

(iii) Regional Imbalance: When industries are concentrated in only a few regions, other areas of the country remain underdeveloped. This creates uneven development, where one part of the country is industrially advanced while others lack basic infrastructure and job opportunities.

(iv) Risk of Industrial Decline: If the main industry in a localised area suffers a downturn due to a fall in demand or shortage of raw materials, the entire area may be affected. Since the economy of the region depends on one industry, its collapse may lead to mass unemployment and economic hardship.

(11a)

(PICK ANY TWO)

(i) A budget deficit occurs when a government’s expenditure exceeds its revenue, while a budget surplus occurs when a government’s revenue exceeds its expenditure.

(ii) Budget deficit often leads to borrowing or debt accumulation, while a budget surplus allows for savings or debt repayment.

(iii) Budget deficits can be used to stimulate economic growth during a recession, while surplus budgets are used to control inflation.

(iv) Budget deficits can cause currency depreciation due to borrowing, while surplus budgets can improve investor confidence and currency stability.

(11b)

(PICK ANY FOUR)

(i) Capital Formation: The stock exchange provides a platform for companies to raise long-term capital by issuing shares and bonds to the public. This allows businesses to obtain necessary funds for expansion, innovation, and investment in productive activities. It helps mobilize savings from individuals and institutions and directs them into sectors that promote economic development and industrial growth.

(ii) Provides Liquidity: One major function of the stock exchange is to provide liquidity to investors. It allows individuals and institutions to easily convert their investments (shares, bonds, etc.) into cash by selling them when needed. This flexibility encourages more people to invest, knowing they can retrieve their funds at any time through market transactions without much delay.

(iii) Pricing of Securities: The stock exchange facilitates the determination of the market price of securities based on the forces of demand and supply. Through continuous trading, the true value of shares and other instruments is revealed. This transparent pricing helps investors make informed decisions and also signals the performance and profitability of companies to the general public.

(iv) Encourages Investment: By providing a safe, regulated, and organized platform for buying and selling securities, the stock exchange encourages the public to invest their surplus funds rather than keeping them idle. This investment culture leads to increased capital availability, wealth creation, and a more active participation in national economic growth.

(v) Aids Government Financing: Governments can raise funds for development projects through the sale of bonds and treasury bills on the stock exchange. These funds are used to finance infrastructure like roads, schools, and hospitals. It provides an alternative to excessive borrowing from foreign sources and helps manage public debt more effectively within a local framework.

(vi) Promotes Economic Growth: The stock exchange channels funds from savers to firms and government institutions that require capital for productive purposes. This flow of investment into various sectors leads to job creation, expansion of businesses, increased output, and overall economic growth. It is a key component in a country’s financial development and industrialization.

(vii) Protects Investors: The stock exchange operates under strict rules and regulations enforced by bodies like the Securities and Exchange Commission (SEC). These regulations protect investors from fraud, insider trading, and manipulation. By ensuring fairness and transparency in trading activities, it builds investor confidence and maintains order in the capital market.

(viii) Indicator of Economic Performance: The performance of the stock exchange often reflects the overall health of the economy. A bullish (rising) market suggests investor confidence and economic growth, while a bearish (falling) market may signal economic downturn or uncertainty. Policymakers and economists use stock exchange trends to forecast and assess the country’s economic outlook.

(12)

(PICK ANY FIVE)

(i) Improved Working Conditions: The government can reduce brain drain by providing better working conditions for professionals, especially in sectors like healthcare, education, and technology. This includes equipping workplaces with modern facilities, reducing workload stress, and ensuring safety. When professionals have a comfortable and efficient environment, they are more likely to remain in the country rather than seek opportunities abroad.

(ii) Attractive Remuneration Packages: Offering competitive salaries, allowances, and incentives can discourage professionals from leaving Nigeria. Many skilled workers travel abroad due to poor wages. If the government ensures regular and attractive pay, coupled with performance bonuses and pensions, professionals will feel valued and financially secure enough to build their careers within the country rather than seeking greener pastures elsewhere.

(iii) Investment in Education and Research: Government investment in education and research institutions can help retain talent. When students and academics are exposed to world-class facilities, funded research projects, and innovative learning environments, they are encouraged to stay. Scholarships, grants, and partnerships with international institutions will also give professionals reasons to remain and grow their careers within the Nigerian system.

(iv) Provision of Social Amenities: Improving public infrastructure such as electricity, water supply, housing, transportation, and healthcare will enhance citizens’ quality of life. Many professionals migrate because of poor living conditions. If basic amenities are made reliable and accessible, people will be more likely to remain in the country, as they can enjoy a decent standard of living without relocating.

(v) Political Stability and Security: A stable political environment and enhanced national security can reduce brain drain. Professionals prefer countries where they and their families are safe. Government must address insecurity, reduce corruption, and promote good governance. When citizens are confident in the country’s leadership and safety, they are more likely to stay and contribute to national development.

(vi) Creation of Job Opportunities: The government should focus on job creation in sectors like ICT, healthcare, engineering, and education. Establishing youth empowerment programs, supporting startups, and investing in industries can provide more employment opportunities for skilled Nigerians. When people can find meaningful and rewarding work within the country, the desire to travel abroad for job opportunities will greatly reduce.

(vii) Reintegration Programs for Returnees: The government can create programs to support Nigerians who wish to return home after working abroad. These may include tax reliefs, housing schemes, grants, or guaranteed job placements. Such reintegration efforts will encourage professionals to bring their skills and experiences back home, reducing brain drain and contributing positively to national growth and innovation.